uber eats tax calculator canada

Large pizza with 2 toppings is 1599tax Sometimes theyll have a party size 1 topping for 1999. Uber Eats Income.

Turbotax Canada Uber Partner Webinar For The 2017 Tax Year Youtube

As such Uber drivers must keep records of the money they receive.

. C lear formatting Ctrl. Recent research shows that Australians spend over 26 billion each year on food and drink delivery through companies such as Menulog UberEats and Deliveroo. But I usually just throw them a 20 for the large and call it even.

How to Track Your Miles As a Delivery Contractor with Doordash Grubhub Uber Eats Instacart etc. This is the easiest method and can result in a higher deduction. Create a f ilter.

If you enjoyed make. You may have heard that Uber drivers must register for GST but that tax law. The rate you will charge depends on different factors see.

Using our Uber driver tax calculator is easy. WHAT ARE UBERS TAX REGISTRATION NUMBERS. Youll need to enter information such as the name address of your business.

Your average number of rides. If youre a food delivery driver you must have an ABN but you do not have to register for GST. Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings.

1228538970 TQ0001 WILL I STILL BE ABLE TO COMPLETE UBER. Do I just divide by 4 to get weekly. Every mile that you track as a contractor delivering for Doordash Uber Eats.

With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up. According to my Uber Tax Summary I earned 26300 driving with Uber Eats in 2019 but I didnt get a 1099-K. The following table provides the GST and HST provincial rates since July 1 2010.

A l ternating colors. Filter vie w s. S ort sheet.

The articles in the 2021 Tax Guide for Gig Economy Contractors. For your vehicle expenses when you enter your total kms both for the year and for business and the total of all. Uber drivers are considered self-employed in Canada otherwise known as an independent contractor.

Add a slicer J Pr o tect sheets and ranges. Those guys in the shop never. I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it.

In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft Skip the dishes or other ride-sharing drivers are self. So r t range. If your total income before deducting expenses is less than 30000 you will be referred to as a small supplier and you are not required to register for.

GSTHST on Food Delivery. The average number of hours you drive per week. To use this method multiply your total business miles by the IRS Standard Mileage Rate for.

To report self-employment income use the Find button to searchselect the option for Business. Its very tough to write off something like a full car payment or lease though. The only official tax document I got from Uber.

Standard IRS Mileage Deduction. Phone is monthly 110 total. The Canada Revenue Agency requires every ridesharing driver to create a GSTHST account number which must be shared with Uber within 30 days of a first trip.

492210 is the most appropriate Industry code for UBER Eats. If you are currently driving an Uber then this video will show you how to correctly report your income and expenses in your tax return. Uber Rasier Canada Inc.

All you need is the following information. Well send you a 1099-K if. Type of supply learn about what.

Introducing the tax guide for Grubhub Uber Eats Doordash Instacart and other gig economy contractors.

Does Uber Pay You For Gas Mileage Rules Drivers Need To Know

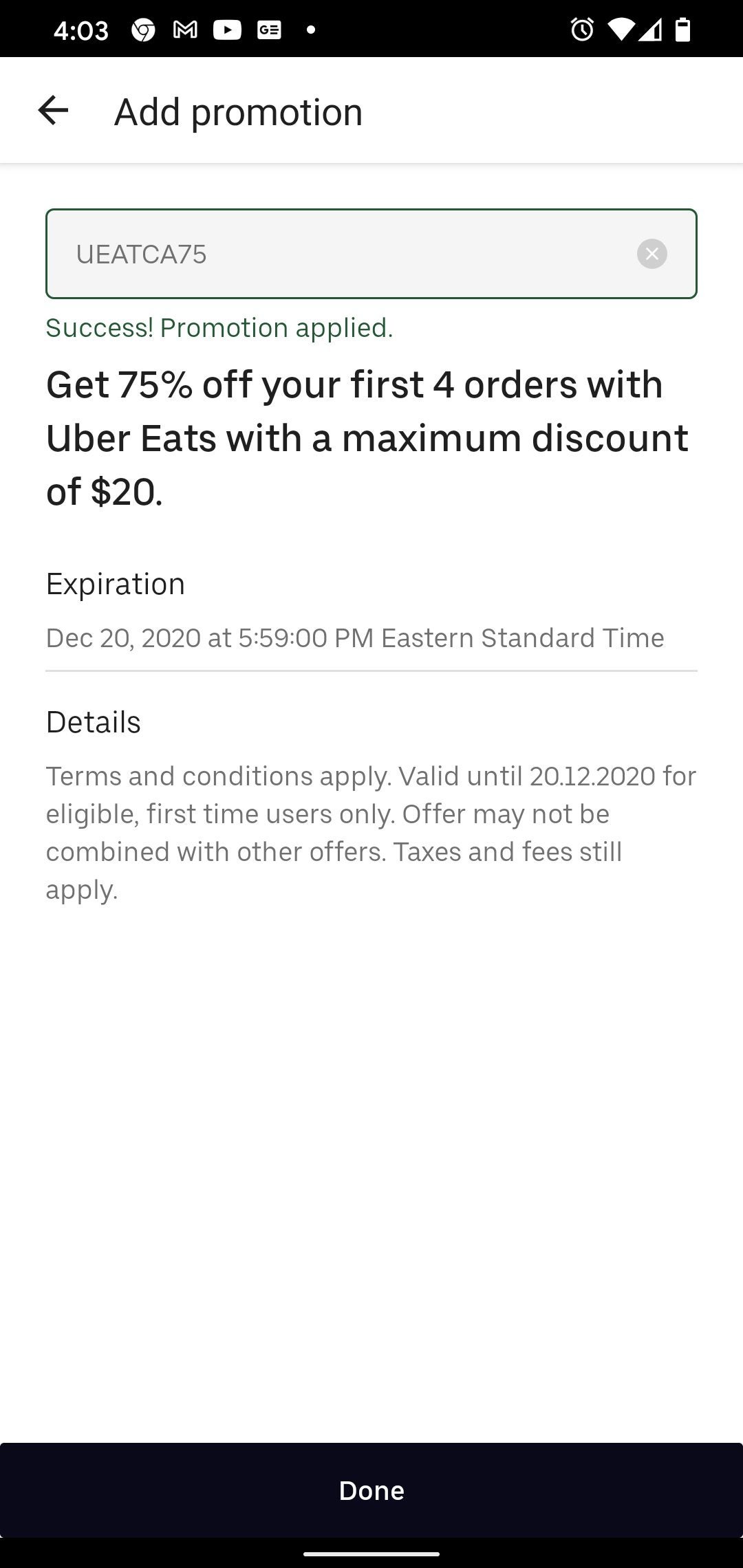

Uber Eats Uber Eats 75 Off 4x For New Users Ymmv Redflagdeals Com Forums

Become A Rideshare Driver In Your City Uber

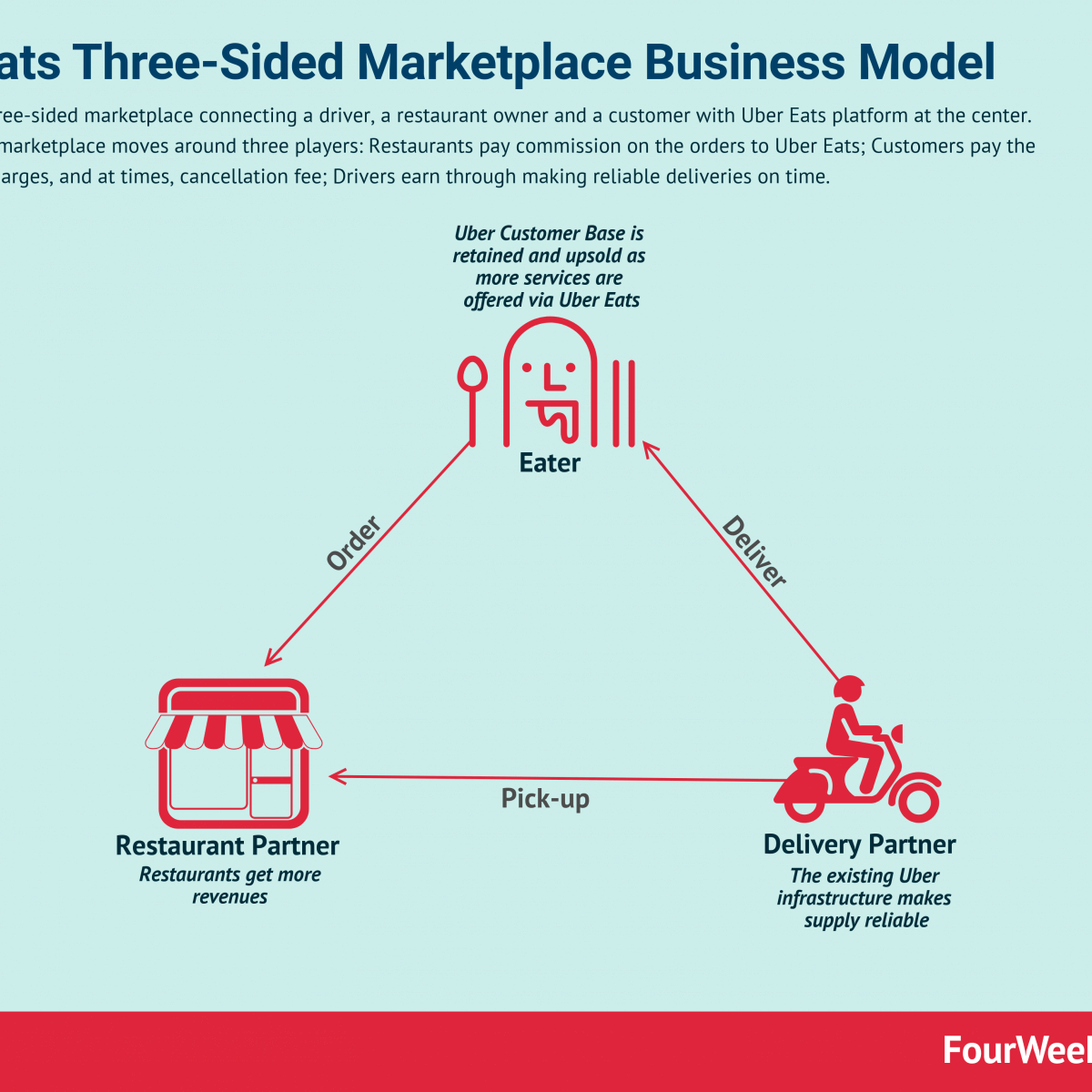

The Uber Eats Business Model Fourweekmba

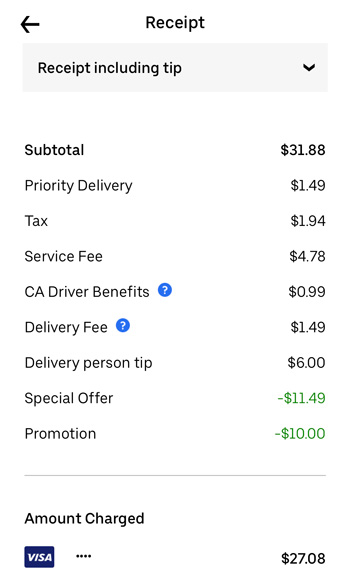

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How Does Uber Make Money Uber Business Model Analysis 2022 Fourweekmba

Uber Eats Get 20 Off Your Next 30 Convenience Order Ymmv Redflagdeals Com Forums

Does Uber Pay You For Gas Mileage Rules Drivers Need To Know

Ubereats Winnipeg Driver Pay And Requirements To Sign Up

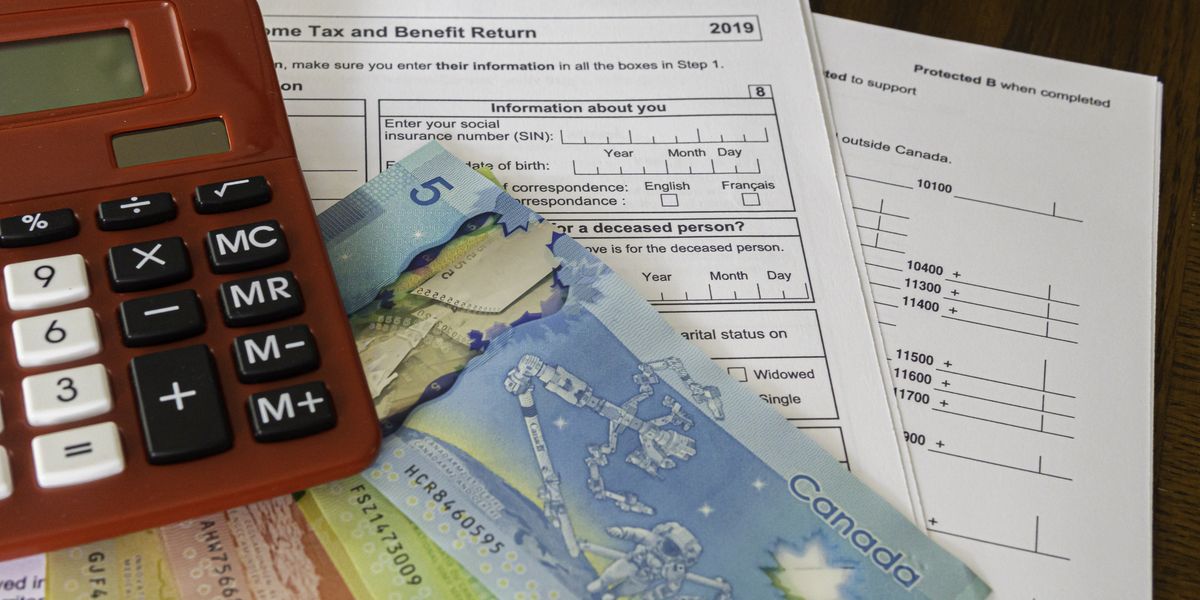

Tax Help Canada 8 Things The Cra Wants You To Remember This Year Narcity

Uber Eats Ubereats 20 Off 30 Order Ymmv Redflagdeals Com Forums

Uber Eats Ymmv 40 Off 30 Or More Redflagdeals Com Forums

Become A Rideshare Driver In Your City Uber

Ubereats Orlando Pay For Drivers

How Much Tax Do Uber Drivers Pay Canada Cubetoronto Com

Become A Rideshare Driver In Your City Uber

Become A Rideshare Driver In Your City Uber

Proof That You Can Make 900 1400 Wk With Uber Eats Alone I M Only 20 So I Can T Drive People Around I Don T Want To Either R Uberdrivers

Uber Drivers Gross Income Vs Net Income Turbotax Tax Tip Video Youtube